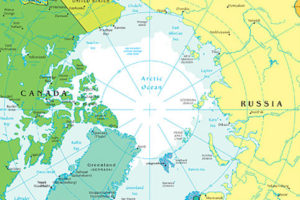

NEWSLINK: “Little cash for Russia’s new Arctic development program; Ambitions are sky-high, but much hinges on private investments” – The Independent Barents Observer/ Atle Staalesen

“… The new Russian Arctic program has undergone major revision since the Ministry of Economic Development was commissioned to make a draft. The Ministry first proposed to allocated 209 billion rubles (€3.1 billion) of state cash to program implementation. Later, the sum was reduced to only 12 billion rubles (€177 million). Originally, the program was to cover the period until […]

» Read more