Russia Can Wait for $70 Oil Before Re-Entering Arctic Waters

(Bloomberg – bloomberg.com – Elena Mazneva, Dina Khrennikova – March 29, 2017)

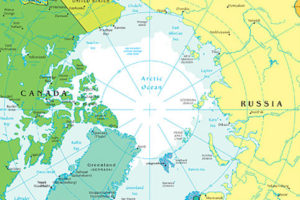

Russia can wait for a sustained recovery in oil prices before drilling again in Arctic waters, relying for now on less costly regions even as rival producer Norway accelerates development of its northerly fields.

“We estimate production costs for the Russian Arctic offshore in the range of $70 to $100 a barrel,” Energy Minister Alexander Novak said by email. These reserves “are our backup stock,” he said before the International Arctic Forum in Russia’s Arkhangelsk that began Wednesday.

While crude is languishing at around $51 a barrel — less than half the price of mid-2014 — analysts at Morgan Stanley forecast a rebound to $70 by the end of 2019 as bloated global stockpiles decline. As Russia waits, Norway’s Arctic waters may host a record number of wells this year following recent discoveries, new government license awards and efficiency gains.

Russia plans to boost exploration in the Arctic Barents and Kara seas from 2019, according to Novak. In the meantime, the cost of offshore development may fall as Russian companies adopt new technologies, he said.

“Offshore Arctic is interesting but it needs to be commercially competitive,” David Campbell, president of BP Plc’s Russia business, said in an interview during the Arkhangelsk forum on Wednesday. “Its reserves, I am confident, will be there for future generations,” he said, commenting on the general prospects for development rather than BP’s own plans.

Onshore Focus

Russia has almost 60 percent of its known hydrocarbon resources in the Arctic and has spent about $100 billion on energy projects in the region over the past decade, according to Bloomberg calculations based on data from operating companies. The vast majority of that investment has been in the less-costly onshore developments.

“If we talk about the cost of producing onshore Arctic, it’s barely different from that in other Russian provinces,” Novak said. “Given our geographical location, operating in the Arctic isn’t something unusual for us.”

Russia’s Arctic in numbers:

- Arctic projects accounted for 81 percent of Russia’s natural-gas output and 17 percent of crude production last year, according to Novak.

- The country’s Arctic zone is home to 346 hydrocarbon fields, including 19 deposits offshore.

- More than 90 percent of potential hydrocarbon resources on the Arctic shelf are still unexplored, according to the Natural Resources Ministry.

Investments in the Russian Arctic may reach $400 billion to $600 billion in the next 20 years, Novak said at the Arkhangelsk forum. Moscow-based Gazprom Neft PJSC has signed an accord with India’s Oil & Natural Gas Corp. on possible offshore exploration in Russia, including at the Arctic Dolginskoye field, he said, adding that China is also showing a “big interest” in the Russian Arctic.

Chinese Vice Premier Wang Yang attended the forum Wednesday. His spokesmen declined to comment on his agenda.

Russia has retreated from Arctic waters since crude’s collapse began in 2014. Development of its most recent northern offshore discovery — a billion-barrel oil find in the Kara Sea by state-run Rosneft PJSC and the U.S.’s Exxon Mobil Corp. in 2014 — has languished amid international sanctions.

©2017 Bloomberg L.P. All Rights Reserved. Article also appeared at bloomberg.com/news/articles/2017-03-28/russia-can-wait-for-70-oil-before-returning-to-arctic-waters