Russia and Ukraine Have Bigger Problems Than Each Other

(Bloomberg – bloomberg.com – Matthew C. Klein – March 3, 2014)

Matthew C. Klein is a writer for Bloomberg View

You may have missed it amid the ongoing drama in Ukraine, but Russia’s central bank raised its main interest rate today to 7 percent from 5.5 percent — the single biggest increase in Russian benchmark rates since the country desperately tried to retain foreign capital before the 1998 default. It’s the Bank of Russia’s latest attempt to arrest the decline of the ruble, which has lost 20 percent of its value against the euro since May as private investors pull their money out of the country.

Monetary tightening is a problem when the economy is weakening. Russia’s stock index is down 11 percent on the news. Real gross domestic product growth has already slowed from 5.1 percent in 2011 to just over 1 percent in 2013. Car sales fell by 5.5 percent in 2013, despite the Russian government’s introduction of subsidized auto loans.

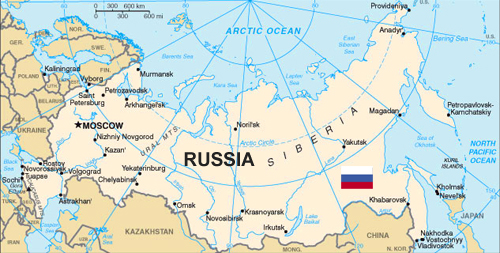

If that weren’t bad enough, European demand for natural gas — about 30 percent of which comes from Russia — has been steadily falling since 2010. Additional supply could come on line in the coming years from the U.S. and Israel at the same time as Russia expands its own production capacity. The net effect could be a glut that would lower prices and further reduce Russia’s access to hard currency.

Meanwhile, world oil prices have been flat for years, while Russian production costs have rapidly increased. Some analysts think Putin’s recent adventurism in Ukraine has been an attempt to distract his domestic constituents from these unpleasant economic prospects.

Ukraine’s predicament also shouldn’t obscure the slow-motion train wreck of its economy, which has been in and out of recession for years and arguably explains much of the recent political unrest. Ukrainian real income growth has badly lagged that of many post-Communist European states that started from similar levels, such as Slovakia, Poland, Romania and Bulgaria. Many analysts blame botched privatizations, insufficient investment and an overvalued currency for this under-performance, although the root causes of those failings are probably extreme levels of corruption and an underdeveloped legal system.

One result has been a gaping current account deficit of more than 7 percent of GDP. Exports of steel and wheat have been insufficient to cover imports of Russian gas. And while Ukraine may contain large reserves of shale gas, eventually reducing its dependence on Russia, those reserves haven’t been exploited by foreign companies because of rules limiting exports.

In lieu of payment at market prices, Russia often offers Ukraine discounted pricing on winter heat in exchange for diplomatic favors, such as the long-term lease that Russia signed for a naval base in the Crimean port of Sevastopol. Russia has also made low-interest loans to the Ukrainian government, although it isn’t clear what would happen to them if Ukraine defaults on its debts. Presumably the U.S. and Europeans wouldn’t want the International Monetary Fund to provide bailout funds that would go straight to the Kremlin.

These economic factors may not affect the short-term decisions of Russian president Vladimir Putin and his Western counterparts, but they may have a much greater impact on the future well-being of Ukrainians and Russians than saber rattling.

Article ©2014 Bloomberg L.P. All Rights Reserved. Article also appeared at http://www.bloombergview.com/articles/2014-03-03/russia-and-ukraine-have-bigger-problems-than-each-other