Looking down the Russia-China pipeline from Beijing’s end

(Business New Europe – bne.eu – COMMENT: Karine Hirn, Partner and Senior Advisor at East Capital – June 17, 2014)

The $400bn Russian gas pipeline deal has been hailed as a game-changer for Russia, but what does it mean for China? Pipelines are the geopolitical equivalent of marriage and China has happily tied itself to Russia for the next 30 years at least.

The most obvious benefit is 38 billion cubic metres (bcm) of gas per year that will be delivered to China’s northern border over the next three decades. Most of China’s economic development has taken place along its coast, with the interior and some of the Northern Territories remaining economically backward. Copious amounts of cheap energy will help the government in Beijing to develop this part of the country, and close the social imbalances and inequality gap with the more developed southern and coastal Chinese provinces.

But the deal is more important for the impact it will have on the whole country: diversifying China’s sources of imported gas; cheaper gas for the whole country; and ensuring long-term stable supplies of gas for the energy hungry economy.

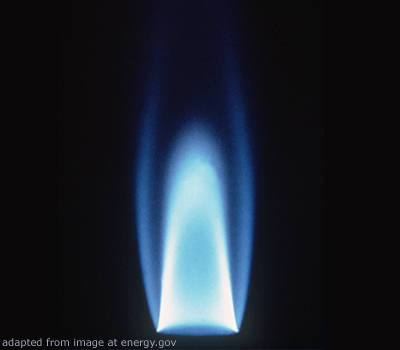

Russian gas supplies also address a second social issue that threatens to undermine Beijing’s authority: pollution. Still heavily reliant on coal to meet China’s burgeoning energy needs – gas penetration as a share of overall fuel use remains at a low 27.5% of the total in urban areas – the air quality has suffered and is becoming a real issue, especially for the emerging middle class. Replacing coal with gas as the fuel for power stations would solve this problem at a stroke, but it is a gradual process. The government has already been targeting cities when it comes to making use of its existing gas consumption, and gas penetration in the most developed regions – such as Beijing, Shanghai, Tianjin – has already exceeded 60%.

The Russian deal for 38bcm a year through a Siberian pipeline is roughly equivalent to a quarter of China’s current gas consumption, and less than 10% of its estimated demand by 2020. In 2013 China consumed 170bcm of natural gas, and expects to consume up to 250bcm in 2015, according to the government. That’s a cumulative increase over five years of 19% a year, if the economic growth targets are met. By 2020, China should be consuming 420bcm in total, of which 120bcm needs to be imported.

Russia could play a big role in supplying China with its imported gas needs. Firstly, there are clauses in the contract that would allow Russia to double its delivery of gas over the lifetime of the deal to 68bcm a year. While the initial investment into pipelines calls for the Russians to spend $55bn and China another $22bn on new pipelines on each side of the border, there are also plans for a second pipeline through Russia’s Altai mountains to the XinJiang province, which could carry another 30bcm a year. Analysts in Beijing believe this second pipeline could appear sooner rather than later.

The map above of China’s regions shows clearly that Xinjiang is already one of the fastest growing provinces in China, albeit from a very low level. The cities in these northern territories are already industrializing extremely fast and the quality of infrastructure, such as roads and railways, has already improved vastly.

Clearly Russian gas is never going to substitute China’s need to import gas from elsewhere, but it will give it a very useful bargaining chip in negotiating with suppliers of alternative sources such as liquefied natural gas (LNG) suppliers from the Middle East and Australia. The ability to increase imports from Russia means that Beijing should be able to push down the price of LNG supply coming from the other direction.

Currently the deal is a pragmatic arrangement to supply China with 10% of its future natural gas consumption. However, Beijing and Moscow are already talking about establishing “a comprehensive energy cooperation partnership” that will bring the two powers even more closely together.

In order for China to make much use of gas, lots of investment needs to be poured into the domestic gas distribution system. It is another testament to the strategic nature of the new relationship, as governments do not undertake that sort of commitment to infrastructure spending if they are not sure of their counterparty.

The Russian gas western line will connect to the current West-to-East Line 2, which is a trunk pipeline starting from the Xinjiang Tarim basin and ending in Shanghai. China’s domestic gas pipeline construction has been going on for over a decade, so initially the additional capital expenditure on new pipelines within China should be limited. The government now encourages private capital into pipeline construction business as well, which will open up a whole new class of investment opportunity for investors.

Energy supply is of strategic importance to the country and demand for natural gas is solid. Beijing is convinced it is worth spending on, but the question is more of who will bear the cost. Economic incentives for gas need to be improved and have already engendered an ongoing gas pricing regime reform to put the business on a commercial basis.

Energy supply is of strategic importance to the country and demand for natural gas is solid. Beijing is convinced it is worth spending on, but the question is more of who will bear the cost. Economic incentives for gas need to be improved and have already engendered an ongoing gas pricing regime reform to put the business on a commercial basis.

The closer relations with Moscow that have been cemented with the gas deal will be extended into other areas as well: China is very interested in Russia’s potential water supplies from the Siberian rivers for its barren north-eastern territories, as well as land leasing for food cultivation and logging.

The political dimensions of the deal are also significant. China clearly now views Russia as an important international ally, which was underscored when President Xi Jinping chose to visit Moscow on his first official visit abroad last spring. To China, Russia is important as a partner facing the hegemonic hold on international politics enjoyed by the US.